The award-winning WIRED UK Podcast with James Temperton and the rest of the team. Listen every week for the an informed and entertaining rundown of latest technology, science, business and culture news. New episodes every Friday.

…

continue reading

Inhalt bereitgestellt von LessWrong. Alle Podcast-Inhalte, einschließlich Episoden, Grafiken und Podcast-Beschreibungen, werden direkt von LessWrong oder seinem Podcast-Plattformpartner hochgeladen und bereitgestellt. Wenn Sie glauben, dass jemand Ihr urheberrechtlich geschütztes Werk ohne Ihre Erlaubnis nutzt, können Sie dem hier beschriebenen Verfahren folgen https://de.player.fm/legal.

Player FM - Podcast-App

Gehen Sie mit der App Player FM offline!

Gehen Sie mit der App Player FM offline!

“Where is the Capital? An Overview” by johnswentworth

Manage episode 519990485 series 3364760

Inhalt bereitgestellt von LessWrong. Alle Podcast-Inhalte, einschließlich Episoden, Grafiken und Podcast-Beschreibungen, werden direkt von LessWrong oder seinem Podcast-Plattformpartner hochgeladen und bereitgestellt. Wenn Sie glauben, dass jemand Ihr urheberrechtlich geschütztes Werk ohne Ihre Erlaubnis nutzt, können Sie dem hier beschriebenen Verfahren folgen https://de.player.fm/legal.

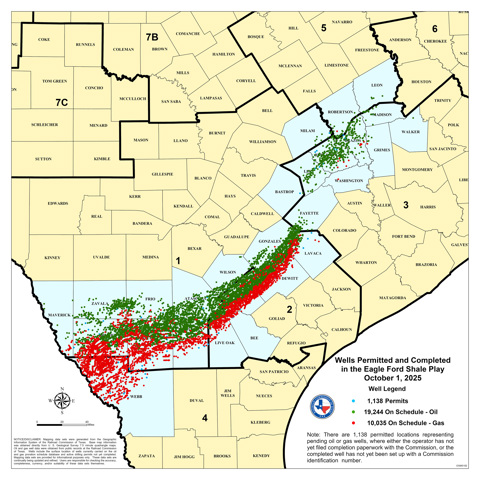

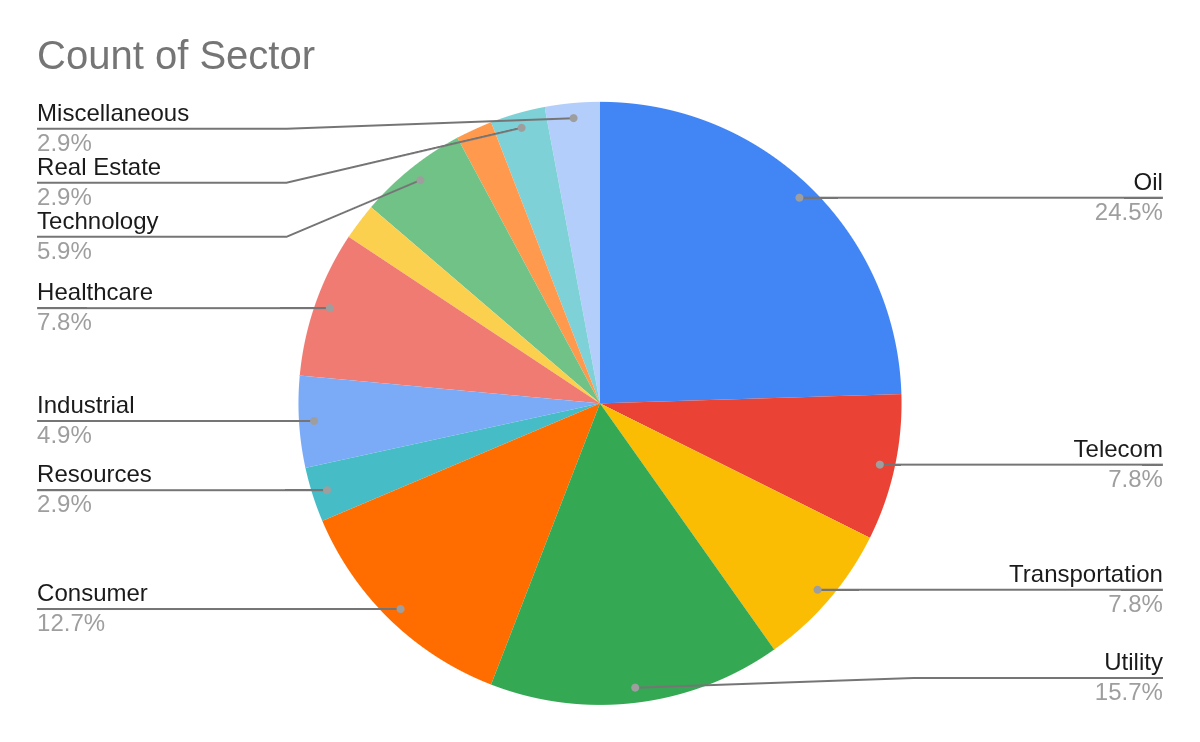

When a new dollar goes into the capital markets, after being bundled and securitized and lent several times over, where does it end up? When society's total savings increase, what capital assets do those savings end up invested in?

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

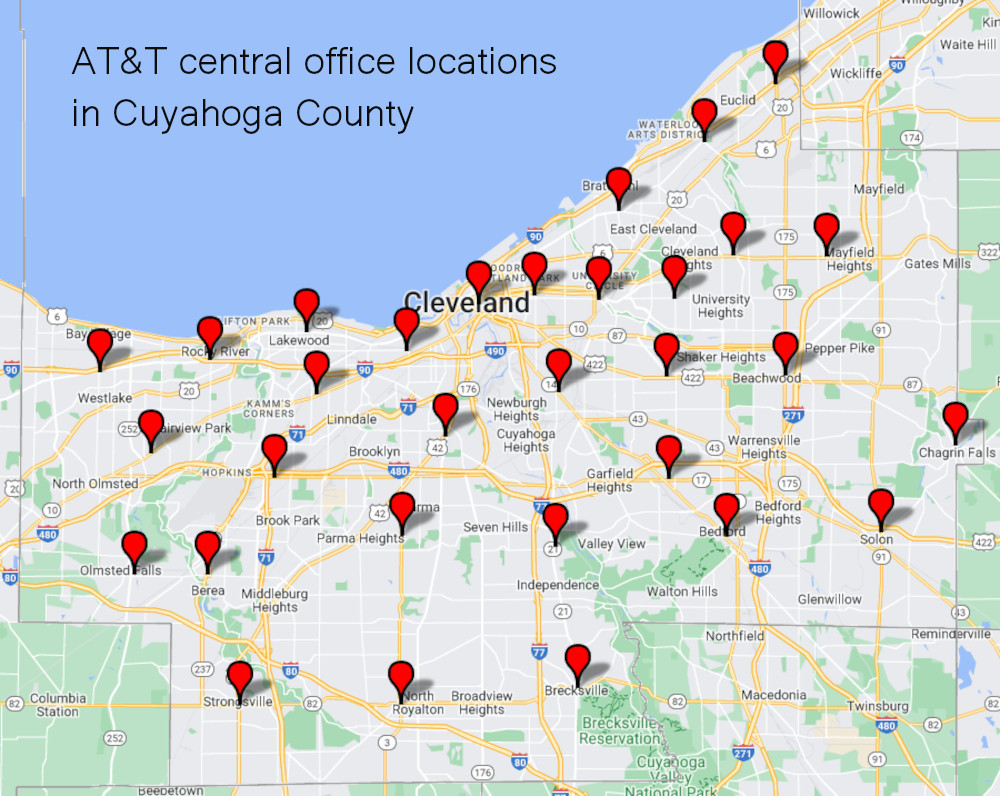

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

…

continue reading

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

679 Episoden

Manage episode 519990485 series 3364760

Inhalt bereitgestellt von LessWrong. Alle Podcast-Inhalte, einschließlich Episoden, Grafiken und Podcast-Beschreibungen, werden direkt von LessWrong oder seinem Podcast-Plattformpartner hochgeladen und bereitgestellt. Wenn Sie glauben, dass jemand Ihr urheberrechtlich geschütztes Werk ohne Ihre Erlaubnis nutzt, können Sie dem hier beschriebenen Verfahren folgen https://de.player.fm/legal.

When a new dollar goes into the capital markets, after being bundled and securitized and lent several times over, where does it end up? When society's total savings increase, what capital assets do those savings end up invested in?

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

…

continue reading

When economists talk about “capital assets”, they mean things like roads, buildings and machines. When I read through a company's annual reports, lots of their assets are instead things like stocks and bonds, short-term debt, and other “financial” assets - i.e. claims on other people's stuff. In theory, for every financial asset, there's a financial liability somewhere. For every bond asset, there's some payer for whom that bond is a liability. Across the economy, they all add up to zero. What's left is the economists’ notion of capital, the nonfinancial assets: the roads, buildings, machines and so forth.

Very roughly speaking, when there's a net increase in savings, that's where it has to end up - in the nonfinancial assets.

I wanted to get a more tangible sense of what nonfinancial assets look like, of where my savings are going in the physical world. So, back in 2017 I pulled fundamentals data on ~2100 publicly-held US companies. I looked at [...]

---

Outline:

(02:01) Disclaimers

(04:10) Overview (With Numbers!)

(05:01) Oil - 25%

(06:26) Power Grid - 16%

(07:07) Consumer - 13%

(08:12) Telecoms - 8%

(09:26) Railroads - 8%

(10:47) Healthcare - 8%

(12:03) Tech - 6%

(12:51) Industrial - 5%

(13:49) Mining - 3%

(14:34) Real Estate - 3%

(14:49) Automotive - 2%

(15:32) Logistics - 1%

(16:12) Miscellaneous

(16:55) Learnings

---

First published:

November 16th, 2025

Source:

https://www.lesswrong.com/posts/HpBhpRQCFLX9tx62Z/where-is-the-capital-an-overview

---

Narrated by TYPE III AUDIO.

---

679 Episoden

Alle Folgen

×Willkommen auf Player FM!

Player FM scannt gerade das Web nach Podcasts mit hoher Qualität, die du genießen kannst. Es ist die beste Podcast-App und funktioniert auf Android, iPhone und im Web. Melde dich an, um Abos geräteübergreifend zu synchronisieren.